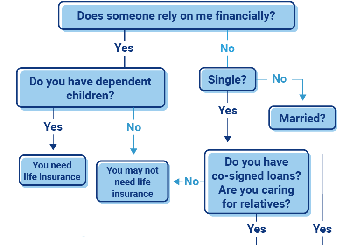

If there is anyone relying on you financially, you need life insurance. The day that you die, your income stops. But your dependants will still have to pay for your mortgage, groceries, heat and all of the other bills. Life insurance should replace your contribution to the household budget for as long as your family needs it to. For example, if your family needs you to cover at least $2,800 a month of household expenses to maintain their lifestyle for the next 20 years, you would need $500,000 of life insurance coverage, assuming a 5-per-cent after-tax rate of return and 2-per-cent inflation.

People have the greatest need for life insurance early in their adult lives when there are minimal financial assets coupled with high costs, such as child care, and significant debt, such as a mortgage. The unexpected death of a spouse at this stage of life would be financially devastating. Conversely, a retiree likely has substantial financial assets in investments or pensions, independent children and minimal debt. The death of a spouse at this stage of life would have less of a financial impact.

There are two main types of life insurance: term insurance and permanent insurance. Term insurance has a guaranteed premium (cost) for a fixed term, usually 10 or 20 years. After the term has expired, the premium goes up, often substantially. If the insurance planning was done well, your life insurance need at the end of the term will be minimal, and you can cancel the policy instead of paying the higher renewal rates.

Call Alliance Insurance Associates, your trusted partner in all of the insurance needs. 780 490 0053